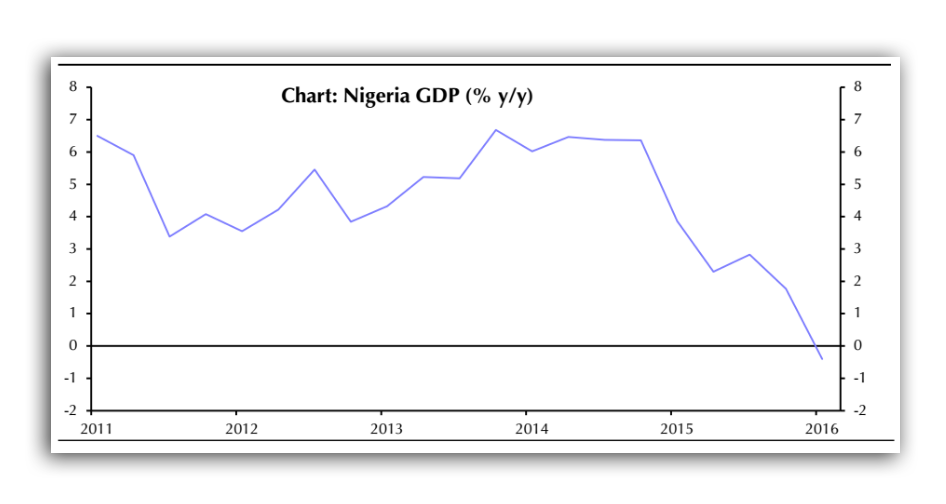

Nigeria’s economic crisis is getting worse.

On Friday, the Nigerian Bureau of Statistics revealed that the economy shrank by 0.4% in the first quarter year-over-year — which was way worse than expected.

Economists were expecting the country to grow by 1.8% year-over-year, according to the Bloomberg consensus.

And now, analysts aren’t feeling too good about the situation going forward.

“We have long warned of a slow-burning crisis in Nigeria. It now seems that this view was too optimistic: the country is headed into a full-blown economic crisis,” argued Capital Economics’ Africa economist John Ashbourne.

Nigeria continues to suffer from numerous economic headaches including lower oil prices and the government’s controversial foreign-exchange and price-control policies (which analysts have more or less deemed a failure.)

Notably, the biggest drop in growth was in Nigeria’s manufacturing sector, which Ashbourne writes was crushed by the FX policies.

“This is very bad news for Nigeria’s government, which has justified the current FX system as a method of promoting non-oil industries,” points out Ashbourne. “It is now clear that these policies have — as we’d long argued — made a bad situation worse.”

Still, the scariest thing about this latest GDP number is that it doesn’t factor in any of the debilitating problems Nigeria has seen in the second quarter, including, but not limited to, the fuel shortage crisis and some of the oil production disruptions by the Niger Delta Avengers.

In short, as Ashbourne concludes grimly, “the worst is yet to come.”

Leave a Reply